GOLD Nível visado: 1716.2531

Rompeu Apoiar nível de 1727.1700 em 13-abr-2021 06:30 UTC

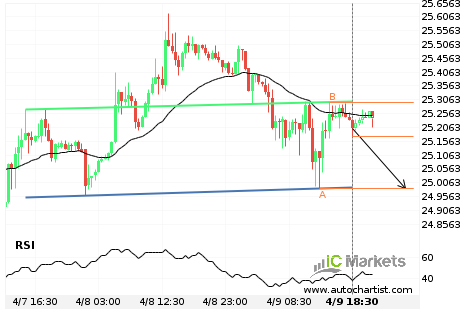

SILVER Nível visado: 24.7150

Cunha descendente identificado em 13-abr-2021 05:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 24.7150 no próximo 12 horas.

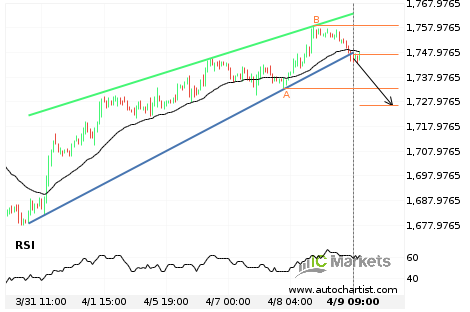

GOLD Nível visado: 1727.3500

Aproximando-Apoiar nível de 1727.3500 identificado em 09-abr-2021 13:00 UTC

SILVER Nível visado: 24.9840

Cabeça e Ombros identificado em 09-abr-2021 18:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 24.9840 no próximo 13 horas.

GOLD Nível visado: 1726.2691

Cunha ascendente quebrou na linha de suporte em 09-abr-2021 09:00 UTC. Possível previsão de movimento em baixa nos próximos 2 dias para 1726.2691

SILVER Nível visado: 24.8520

Canal ascendente identificado em 09-abr-2021 05:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 24.8520 no próximo 22 horas.

GOLD Nível visado: 1745.5000

Triângulo Ascendente identificado em 08-abr-2021 09:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1745.5000 no próximo 3 dias.

SILVER Nível visado: 25.8181

Triângulo Ascendente quebrou na linha de resistência em 08-abr-2021 06:00 UTC. Possível previsão de movimento em alta nos próximos 3 dias para 25.8181

GOLD Nível visado: 1718.1047

Cunha ascendente quebrou na linha de suporte em 07-abr-2021 02:00 UTC. Possível previsão de movimento em baixa nos próximos 17 horas para 1718.1047

SILVER Nível visado: 25.6182

Rompeu Resistência nível de 25.0990 em 06-abr-2021 15:00 UTC